Dollar-Cost Averaging: The Stress-Free Way to Invest in Volatile Markets

Introduction

Investing in financial markets can be a roller-coaster ride, with price fluctuations and market volatility causing stress and uncertainty for many investors. However, there is an investment strategy that can help mitigate some of the anxiety associated with market volatility: dollar-cost averaging (DCA). In this article, we’ll explore what dollar-cost averaging is, how it works, and why it’s considered a stress-free way to invest in volatile markets.

What Is Dollar-Cost Averaging?

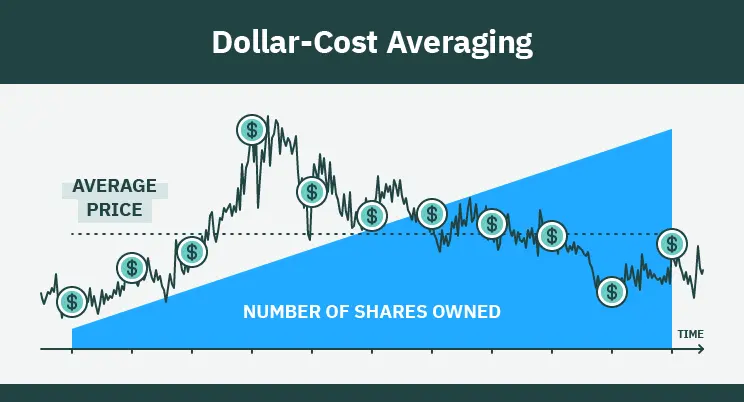

Dollar-cost averaging is an investment strategy where an individual consistently invests a fixed amount of money at regular intervals into a particular asset, regardless of its price. This strategy allows investors to buy more shares when prices are low and fewer shares when prices are high. The goal is to reduce the impact of market volatility on your investment portfolio.

How Dollar-Cost Averaging Works

Here’s a step-by-step explanation of how dollar-cost averaging works:

- Set a Regular Investment Schedule: Decide how frequently you want to invest (e.g., monthly or quarterly) and determine the fixed amount you will invest at each interval.

- Stick to Your Plan: Regardless of market conditions, commit to investing the predetermined amount on your chosen schedule.

- Purchase More Shares When Prices Are Low: During market downturns when asset prices are lower, your fixed investment amount will buy more shares.

- Purchase Fewer Shares When Prices Are High: Conversely, when asset prices are high, your fixed investment amount will buy fewer shares.

Why Dollar-Cost Averaging Is Stress-Free

- Eliminates Market Timing Stress: Timing the market can be a daunting task, and even experienced investors struggle to predict price movements. DCA removes the need to make these difficult decisions, as you invest consistently over time.

- Reduces Emotional Decision-Making: Emotional reactions to market volatility often lead to poor investment choices. DCA encourages discipline and rationality by automating your investment strategy.

- Lowers Average Purchase Price: By buying more shares when prices are low and fewer when they are high, DCA naturally lowers your average purchase price over time.

- Mitigates Risk: Spreading your investments over time reduces the risk of making significant investments at market peaks.

- Encourages Consistency: DCA encourages investors to stay invested in the market over the long term, which is a key component of successful investing.

When Dollar-Cost Averaging May Be Appropriate

Dollar-cost averaging can be an excellent strategy for various scenarios:

- Volatile Markets: DCA is particularly effective in markets with high volatility, as it helps smooth out the impact of price fluctuations.

- Uncertain Economic Conditions: During uncertain economic times, when predicting market movements is challenging, DCA provides stability and a structured approach to investing.

- Long-Term Goals: If you have long-term financial goals, such as retirement planning or saving for your children’s education, DCA allows you to consistently invest over an extended period.

- Regular Income: If you receive a regular income, such as a salary, DCA is a convenient way to allocate a portion of your earnings to investments on a consistent basis.

Conclusion

Dollar-cost averaging is a stress-free investment strategy that allows you to navigate volatile markets with confidence and discipline. By consistently investing a fixed amount over time, you can benefit from market downturns, reduce the impact of market highs, and lower your average purchase price. DCA encourages a rational, unemotional approach to investing, making it an excellent choice for individuals looking to achieve their long-term financial goals without the stress associated with market timing and volatility. Whether you’re a novice investor or a seasoned pro, dollar-cost averaging can provide peace of mind and a proven path to success in the world of investing.